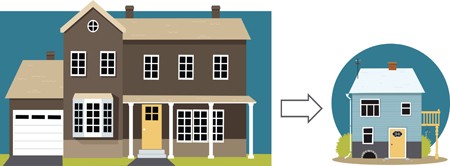

New downsizing cap available

If you are aged 65 or over, your home is your main residence for CGT purposes and you have owned it for a minimum of ten years, you could benefit. You will be able to make additional non-concessional contributions, up to $300,000, from the proceeds of selling your home from 1 July 2018.

The downsizer contribution cap of $300,000 will be in addition to existing caps; the capital must come from the proceeds of the sale price and application must be made within 90 days after the home changes ownership.

There will also be exemption from the contribution rules for people aged 65 and above, and the restrictions on non-concessional contributions for people with total super balances above $1.6 million.

AcctWeb