Late payments hitting SMEs hard

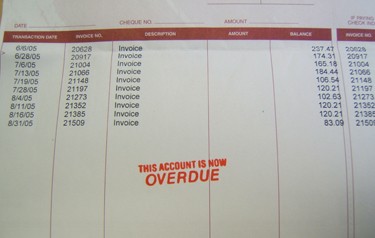

MYOB’s SME Snapshot found 77 per cent of businesses felt some sort of business impact due to a customer not paying their bills on time, while only 23 per cent saw no impact at all.

Thirty-five per cent of business owners cited an impact on their personal finances, and 32 per cent said it affected their ability to cover expenses such as rent and power.

Late payment also takes an emotional toll on SME owners, with 52 per cent confirming it impacts their stress and anxiety levels.

A further 72 per cent agree regulations should be introduced by the government to ensure prompt payment, a sentiment that MYOB chief executive Tim Reed echoed.

“The financial health of Australia’s small business owners should be a top priority and the research indicates this also has a direct impact to their own personal wellbeing,” said Mr Reed.

“Improving this situation to ensure all businesses are being paid on time should be a shared responsibility across federal government and businesses of all sizes,” he added.

“Given the overwhelming support for this initiative, it would be a positive move to see the government and big businesses put forward an initiative to implement a national prompt payment protocol to ensure small businesses are not being delayed payments by other businesses.”

KATARINA TAURIAN

Thursday, 27 October 2016

accountantsdaily.com.au